FD Rates in India : 11 banks in India currently offer 8% and above interest on FDs: Full list

FD Rates in India : 11 banks in India currently offer 8% and above interest on FDs: Full list .Among the highest fixed deposit rates available in India right now, small finance banks dominate the scene.

Among the highest fixed deposit rates available in India right now, small finance banks dominate the scene. NorthEast Small Finance Bank offers the most competitive rate, providing 9.00% per annum for a tenure of 546 days to 1111 days. This is closely followed by Unity Small Finance Bank, which also offers a 9.00% interest rate for 1001 days.

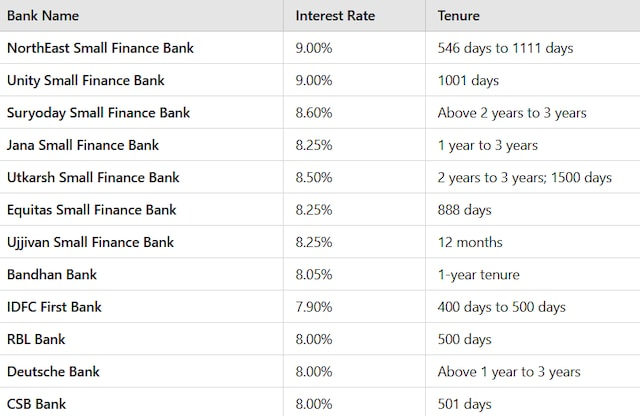

These small finance banks are consistently offering rates higher than most private and public sector banks, making them a popular choice for risk-averse investors. At least 11 banks are currently offering an interest rate of 8 per cent or more in India right now, as per data shared by Paisabazaar. Here is a table summarizing the banks and their respective rates:

Small finance banks are often favored for their higher rates compared to larger financial institutions. The highest FD rates being offered are as follows:

- NorthEast Small Finance Bank: 9.00% for 546 days to 1111 days

- Unity Small Finance Bank: 9.00% for 1001 days

- Suryoday Small Finance Bank: 8.60% for Above 2 years to 3 years

- Jana Small Finance Bank: 8.25% for 1 year to 3 years

- Utkarsh Small Finance Bank: 8.50% for 2 years to 3 years; 1500 days

- Equitas Small Finance Bank: 8.25% for 888 days

- Ujjivan Small Finance Bank: 8.25% for 12 months

Private Sector Banks: Competitive Yet Slightly Lower Rates

Private sector banks offer competitive FD rates, especially for specific tenures.

- Bandhan Bank: 8.05% for 1-year tenure

- IDFC First Bank: 7.90% for 400 to 500 days

- RBL Bank: 8.00% for 500 days

- DCB Bank: 8.05% for 19 months to 20 months

- IndusInd Bank: 7.99% for 1 year 5 months to less than 1 year 6 months

- HDFC Bank: 7.40% for 4 years 7 months (55 months)

- ICICI Bank: 7.25% for 15 months to 2 years

Public Sector Banks: Stable and Reliable Options

Public sector banks, while generally offering lower interest rates compared to their private counterparts, still provide stability and security for investors.

- Bank of Maharashtra: 7.45% for 366 days

- Central Bank of India: 7.50% for 1111 or 3333 days

- Bank of Baroda: 7.30% for 400 days – Bob Utsav

- Bank of India: 7.30% for 400 days

- Canara Bank: 7.40% for 3 years to less than 5 years

- Indian Bank: 7.30% for 400 days – IND SUPER

- Union Bank of India: 7.30% for 456 days

Foreign Banks:

- Deutsche Bank: 8.00% for Above 1 year to 3 years

- HSBC Bank: 7.50% for 601 to 699 days

- Standard Chartered Bank: 7.50% for 1 year to 375 days

FD Rates Have Increased, but Post-Tax Returns Are Still Low

With Thanks and Reference to: https://www.business-standard.com/finance/personal-finance/11-banks-in-india-currently-offer-8-and-above-interest-on-fds-full-list-125011700181_1.html and https://pune.news/finance/fd-rates-in-india-which-banks-offer-the-highest-returns-in-2025-291705/