RBI Monetary Policy Live Updates: RBI hikes repo rate by 50 bps to 5.4%, SDF adjusted to 5.15%

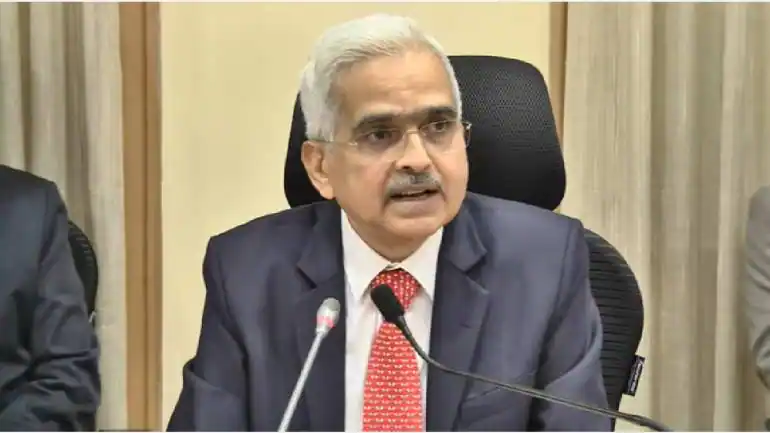

The three-day meeting of the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) started on August 3. Headed by RBI Governor Shaktikanta Das, the MPC is announcing its decision now.As per a Moneycontrol survey, the MPC is likely to raise the repo rate by at least 35 basis points this week. While voting on the interest rate decision, the committee’s members will examine a range of economic indicators to understand where the economy stands.

The Reserve Bank of India (RBI) in the Monetary Policy Committee’s (MPC’s) statement on Friday announced a rate hike of 50 basis points to 5.40 per cent, highest since 2019. The bi-monthly meeting of the RBI MPC started on Wednesday, and RBI Governor Shaktikanta Das on Friday announced that the MPC unanimously decided to hike the policy rate.

Das said, “MPC decided to focus on withdrawal of accommodation to keep inflation within target while supporting growth”. RBI MPC revised the Marginal Standing Facility (MSF) and bank rates to 5.65 per cent from 5.15 per cent, announced Governor Das.

The real GDP projection for FY23 was retained at 7.2 per cent with Q1 at 16.2 per cent, Q2 at 6.2 per cent, Q3 at 4.1 per cent, Q4 at 4 per cent, with risks broadly balanced, governor Das said. Das said that the consumer price inflation remains uncomfortably high and inflation is expected to remain above 6 per cent. He projected that CPI inflation for current fiscal year at 6.7 per cent and that for FY 2023-24 at 5 per cent.

-The US economy is widely feared to be headed towards a recession this year having already contracted by 0.9 per cent in the June quarter and 1.6 per cent in the previous. If an economy contracts for three consecutive quarters, then it is considered that the economy is in recession.

-Barclays note suggests that Jayanth Varma – probably the most hawkish MPC member – was of the view that the MPC cannot impose unacceptable growth sacrifices in order to bring down inflation.

-Barclays note reminds us that, in the likely event that inflation stays above target for 3-consecutive quarters, the RBI will be obliged to write a letter of explanation to parliament.

With Thanks Reference to: https://www.moneycontrol.com/news/business/rbi-monetary-policy-live-updates-shaktikanta-das-to-deliver-mpc-statement-at-10-am-8956821.html, business-standard(https://www.business-standard.com/article/current-affairs/latest-news-live-rbi-mpc-meet-repo-rate-hike-shaktikanta-das-nancy-pelosi-china-taiwan-crisis-imf-122080500158_1.html)