Natco Pharma Shares Jump Over 13% After FY24 Profit Guidance Raise

The Natco Pharma company also announced launches of two-three unique products in the coming 12-18 months

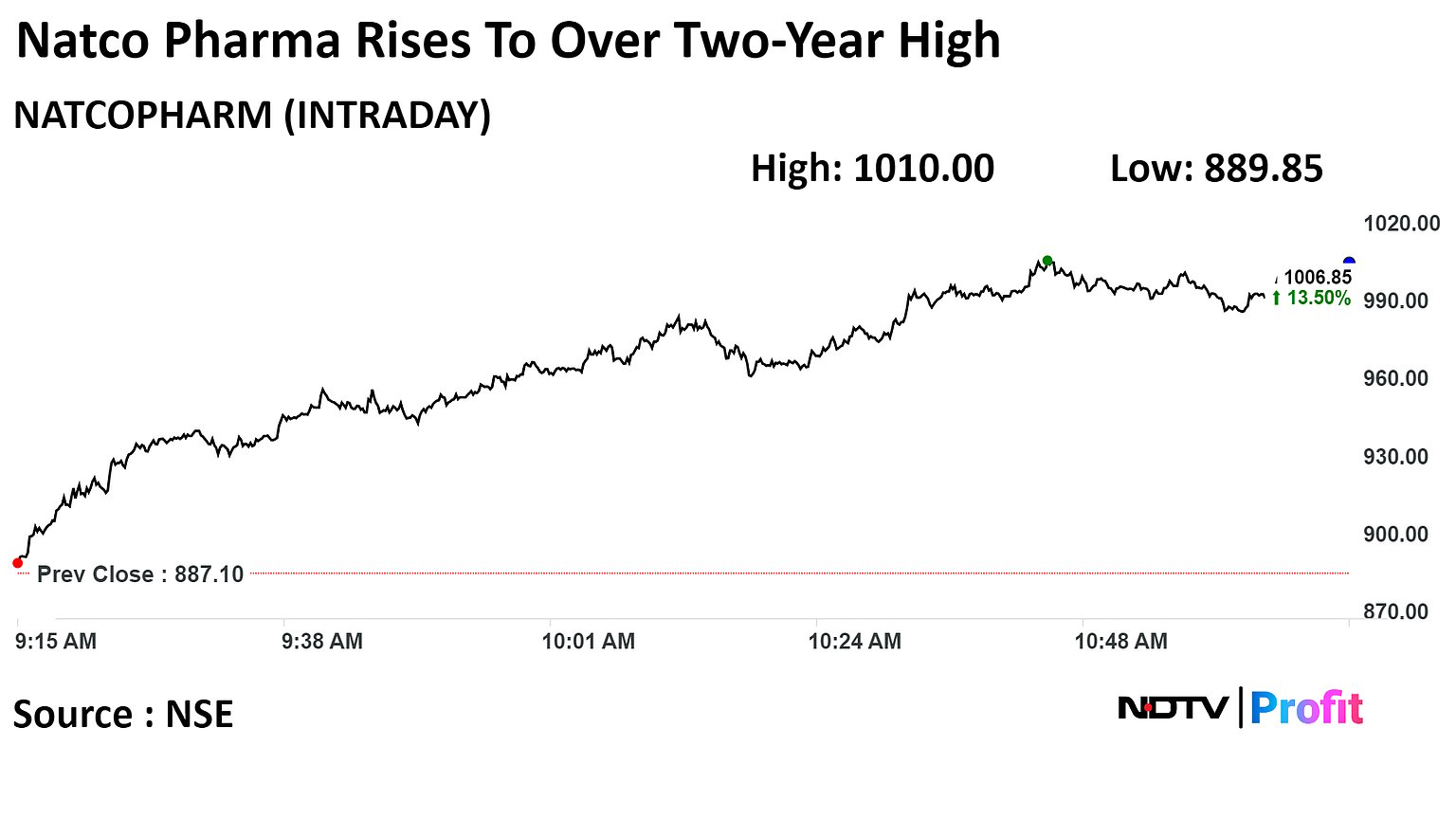

Shares of Natco Pharma Ltd. jumped over 13% on Friday after the company raised its net profit guidance for the ongoing financial year, and announced new product launches.

Natco Pharma raised the guidance for profit after tax to over Rs 1,200 crore, from Rs 1,000-1,200 crore earlier, the company said in a post earnings conference call on Thursday.

The pharmaceutical company also announced launches of two-three unique products in the coming 12-18 months. It is planning to deliver five-six complex products, like peptides.

Natco Pharma feels confident about its growth the U.S. on promising pipelines, including FTF products, such as olaparib and semaglutide, it said.

Shares of the company rose as much as 13.85%, the highest level since Aug. 13, 2021, before paring gains to trade 12.79% higher at 11:08 a.m. This compares to a 0.60% advance in the NSE Nifty 50.

The stock has risen 86.07% in 12 months. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 80.51, implying the stock was overbought.

Of the 15 analysts tracking the company, eight maintain a ‘buy’ rating, five recommend a ‘hold,’ and two suggest ‘sell’, according to Bloomberg data. The average 12-month analysts’ consensus price target implies a downside of 3.1%.

Nuvama said Natco’s gRevlimid opportunity is playing out better than expected, evident from the massive beat in Q3 that is likely to continue till Jan-26 as it is gearing up to supply higher volumes.

“Looking beyond FY25, a robust US pipeline consists of several FTF products such as olaparib, semaglutide (sole FTF in 8mg; partnered Viatris) and erdafitinib (own filing). Besides opportunities such as gLonsurf, Yondelis, Calquence and gKyprolis, among others should pay off in the future. In addition, other growth engines such as RoW markets and subsidiaries have started contributing to growth,” Nuvama said.

Nuvama said there is a possibility of adverse action on the Kothur plant and the risk of pipeline monetisation but it anticipates limited impact on our estimates. Pursuing complex opportunities for long-term growth

“With gRevlimid picking up and Natco pursuing complex opportunities such as CAR-T in India, semaglutide, Olaparib, etc with gRevlimid cash, the long-term outlook is improving. We value Natco using an SoTP, ascribing 25x to base business’s Q3FY26E EPS, yielding Rs 483/share. gRevlimid value is INR380/share (from INR348) and other P-4 opportunities at Rs 194 (from INR187) as we roll over the valuation to Dec-25E. Maintain ‘BUY/SO’ with a target of Rs 1,055 (earlier Rs 980),” it said.

With Thanks Reference to: https://www.ndtvprofit.com/buzzing-stocks/natco-pharma-shares-jump-over-13-after-fy24-profit-guidance-raise and https://www.businesstoday.in/markets/company-stock/story/natco-pharma-stock-up-18-today-26-in-4-day-rally-nuvama-shares-target-price-417818-2024-02-16